For best experience, use Nutshell app on your smartphone.

2:03 pm on 15 February 2022, Tuesday

The card payments market in China, which was affected by the COVID-19 pandemic, is expected to register a strong growth of 17% in 2022, supported by healthy economic recovery, forecasts GlobalData, a leading data, and analytics company.

Kartik Challa, a Senior Payments Analyst at GlobalData, comments: “Card payments market in China, which registered a robust growth over the past decade, was affected in 2020 due to reduced consumer spending and economic uncertainty in the wake of COVID-19. However, the government’s stimulus packages, as well as comprehensive testing and isolation measures, nationwide vaccination and reopening of businesses have laid the path to recovery.”

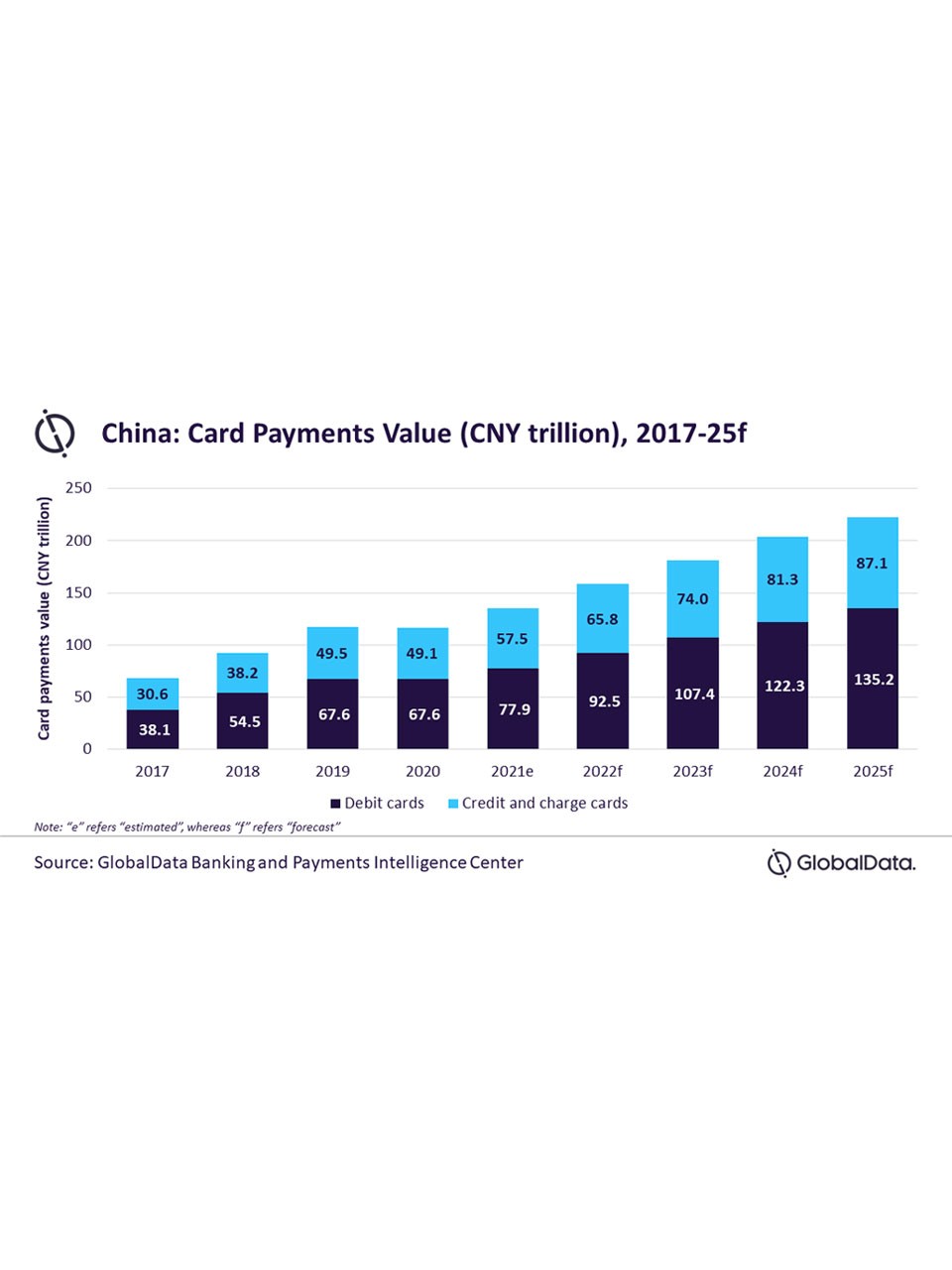

According to GlobalData’s Payment Cards Analytics, the value of card payments is forecast to register a compound annual growth rate (CAGR) of 13.2% between 2021 and 2025 to reach CNY222.3 trillion ($34.0 trillion) in 2025.

With the COVID-19 restrictions now eased and consumer spending rising, both debit and credit card use is expected to increase. In addition, major sporting events such as the Beijing 2022 Winter Olympics and Paralympics are expected to push spending further, thereby benefitting card payments.

GlobalData’s Payment Cards Analytics reveals that debit card payments are set to register a CAGR of 14.8% between 2021 and 2025, while credit and charge cards will grow at a CAGR of 10.9% during the same period.

To drive consumption and push card usage, banks are offering flexible repayment options on credit cards in the form of installments. All the major banks, including BOC, HSBC, and CCB, offer an installment payment facility, allowing credit cardholders to convert their purchases into installments.

In collaboration with card issuers and schemes, China took various measures to support card payments. One such initiative was removing the upper and lower interest rate cap from Jan. 1, 2021. This was previously between 12.78% and 18.25%.

The issuer and card holder can now determine the interest rate through independent negotiation. This will encourage competition in the credit card space and lower costs for credit cardholders.

Challa concludes: “Undoubtedly, 2020 was a tumultuous year for many sectors, and card payments was no exception. After a decade of robust growth, the market experienced its first contraction in 2020. However, with the economy bouncing back and consumer spending rising, the Chinese payment card market is once again ready to surge.”